What To Say To Customer Re Collecting Money Letter

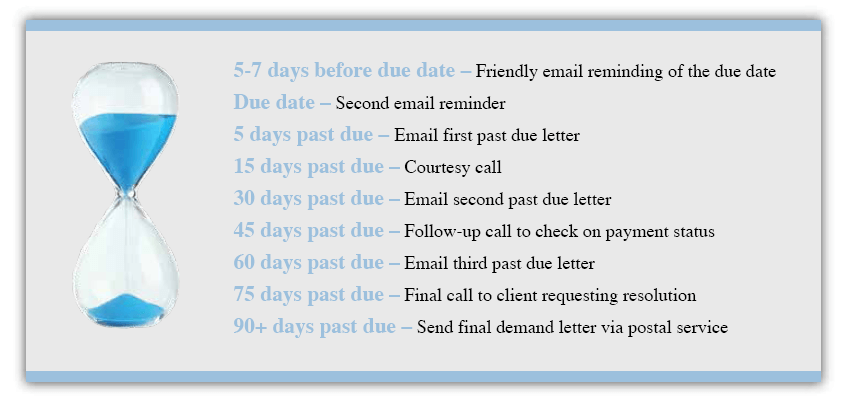

In our previous commodity in this serial, we showed you How to Write the 2d Drove Letter when an invoice is nearly 30 days past-due. If yous're now thinking most how to write the third collection letter, chances are the invoice is now about sixty days past-due and your odds of collecting payment is getting worse by the day. Information technology'south time to send a letter or email that'due south more than strongly-worded and to the point. In this article, we'll provide a template to testify you lot how information technology's done. If you lot're following the strategy we've outlined so far, yous've sent 2 reminders before the due date (in add-on to sending the original invoice) along a first drove letter and second collection letter after the due appointment. Now with the invoice about lx days past-due, things have gone across a bespeak where someone in bookkeeping was on vacation or the client simply forgot to pay. It's time to send a third collection alphabetic character which is your concluding formal written advice earlier sending a demand letter of the alphabet. Exist specific and direct by including the actions you lot plan to take if payment is non received such equally placing the customer on credit agree and/or involving a collections bureau or lawyer. But remember, you take ii goals: to collect the debt and continue your customer. Even though y'all may experience frustrated or even a footling cheated, always keep it professional. Here's a sample of the third collection letter (also chosen a dunning letter) you might send to a client when the invoice has get 60 days past-due: Dearest <Name>, We've repeatedly communicated with you about the status of your account. Invoice number <Invoice_Num> for $<Invoice_Total>, dated <Invoice_Date>, is now significantly past due. Your immediate attending to this matter is required. We value your business concern, but per our company's credit policy, we will be forced to place yous on credit hold if payment is non made within five days of this letter. If you lot're unwilling or unable to pay the amount due within the next xxx days, nosotros are forced to report this debt and brainstorm a formal collections process. Please contact <AR_Rep_Name> immediately to return your account to expert continuing by making a payment today. They can exist reached at <AR_Rep_Phone> or <AR_Rep_Email>. We accept check, credit card, ACH, and wire transfer and can accept your payment using multiple methods. Businesses sometimes face up unexpected challenges. If payment in total today is not possible, we will piece of work with you lot to formulate a satisfactory payment plan. Please requite this matter the attention it deserves and contact us today. Sincerely, <Signature> Note the post-obit in the alphabetic character sample: All written communication (email or messages) sent throughout the accounts receivable and collections process should include copies of the invoice(southward) in question. 💡 TIP: Be certain to follow through and keep your word. If your strategy calls for a customer to be placed on credit hold after 60 days, do then. If your letter of the alphabet states that you'll send a client to a collections bureau later a specific date, send them to collections. If you don't follow through, your client may not take you seriously. Letter of the alphabet and email templates are a vital attribute of an automated and effective collections strategy. They allow you to standardize your approach and then you lot can exam and refine different variations of emails and letters to determine which version is most effective. In addition, using Accounts Receivable and Collections software like Collect-IT helps to manage all client advice besides as standardize the timing of your reminders and collection messages/calls. In fact, hither'southward a cheat sheet for collections timing all-time practices to use as an example of a typical approach a company might utilise: 📝UP Next: Is that invoice STILL outstanding? So check out the next article in this series: Click beneath to download our Ultimate Guide to AR Collections where you'll find 27 pages of skilful advice, best practices, industry benchmarks, and loads of letter templates and telephone call scripts. Larn more than most the topics below: Collect telephone call scripts Accounts Receivable KPIs

Tone of the Third Debt Collection Letter

Third Debt Collection Letter Template – 60 Days By-Due

A/R Collections Timing and Best Practices

How to Prepare for Drove Calls

Want More Tips, Templates and Guidance Like This?

Source: https://www.dynavistics.com/blog/third-collection-letter

Posted by: dicksoniniand59.blogspot.com

0 Response to "What To Say To Customer Re Collecting Money Letter"

Post a Comment